Insurance can be overwhelming and hard to understand, but it's a necessary part of life. It can help us protect the things we care about, and give us peace of mind in difficult times. From understanding the types of insurance available to know what to look for in an insurance plan, this post offers an overview of the basics of insurance and will help you make the best decision for your needs.

1) Types of Insurance

2. Health Insurance

3. Car Insurance

4. Homeowners/Renters Insurance

5. Disability Insurance

2) What to Consider When Choosing an Insurance Plan

1. Assess your current financial situation

2. The best time to get life insurance

3. The amount of coverage you need

4. The types of life insurance to get

5. What affects life insurance rates

3) Insurance Plan Tips: There are 4 types of insurance that you need to pay attention to and refer to, it is attached to your life and your family and supports you in time when something unexpected happens.

2. Health Insurance

3. Long-Term Disability Coverage

4. Auto Insurance

4) Different Insurance Companies

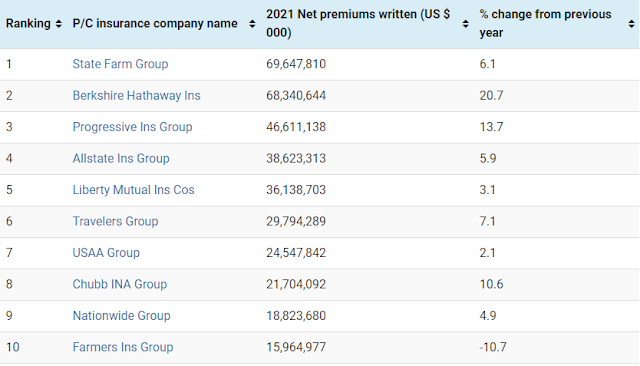

There are over 100 largest P&C insurers in the US, here is just a list of the top 10 largest P&C insurers in the US for you to know and learn more about later

List The largest P&C insurers in the United States

5) Common Insurance Terms

Insurance terms are very important in an insurance contract. Each insurance company and each insurance product has its own provisions for each specific product and insurance object. You should take the time to carefully read the insurance terms specified in your insurance policy to consider choosing the right insurance products for you and your family.

Conclusion: Insurance can seem overwhelming, but knowing the basics can help you navigate the different types of insurance available and make the best choice for your needs. By understanding the types of insurance, what to look for in a plan, and the different insurance companies available, you can rest assured that you’ve made an educated decision about your insurance coverage.

Now that you’ve learned more about insurance, check out different plans and companies available and consider if there are any changes you can make to your current plan. Continue reading other articles on this blog to learn and research before making a decision to buy an insurance product that is right for you.

READ MORE: