When it comes to protecting your most valuable asset, finding the best homeowners insurance in California is essential. With a diverse range of options available, it can be overwhelming to sift through the choices. However, understanding what makes a policy stand out can help you make an informed decision.

First and foremost, consider the coverage options provided by the best homeowners insurance in California companies in California. Comprehensive policies should protect against natural disasters like wildfires and earthquakes—common occurrences in our beautiful state. Additionally, look for insurers that offer customizable plans tailored to your specific needs.

Researching customer reviews can also guide you toward reputable providers known for their excellent service and claims process. The right homeowners insurance in California not only protects your property but also provides peace of mind knowing you're covered when life’s unexpected events occur.

Investing time into finding the best homeowners insurance in California has to offer will ultimately safeguard your investment and ensure that you are prepared for whatever challenges may come your way. Don’t settle; prioritize quality coverage that meets both your budget and needs!

Here is a list of the 7 best homeowners insurance in California that I have screened for pros and cons and reviewed the terms of the policy. In my opinion, these are the best home insurance companies that you should choose when buying insurance. You don’t have to think twice.

1. AMICA

2. USAA

USAA is a membership-only organization that provides insurance, banking, and investment products to active and veteran military members and their families. Its basic homeowners policy includes property coverage for the home, other structures on the property, and personal possessions. Members can customize or extend their coverage to include protection against floods and earthquakes.

3. NATIONWIDE

Nationwide offers investment, banking, and insurance products. Homeowners can purchase standard coverage to protect against common perils, like wind, fire, theft, and water damage, as well as specialty coverage to assist with repairs and replacements after a flood or earthquake. Nationwide also offers several discounts for homeowners to reduce their rates, including discounts for making updates to their heating and cooling, plumbing, and electrical systems.4. LEMONADE:

Lemonade offers home, auto, renters, pet, and life insurance products. All policies are sold online or through the Lemonade app. Once you purchase a policy, you can manage your policy, file claims, and contact customer service through the app as well.

Lemonade’s home insurance policies include basic coverage for your home, other structures, and personal property. California homeowners can further customize their policies by adding earthquake insurance through Palomar, a Lemonade partner. Lemonade also maintains the Lemonade Giveback program, which uses surplus funds to support communities and organizations in need.

5. CHUBB:

Chubb has an A++ rating from AM Best. Chubb offers standard home insurance policies and specialty coverage to protect other assets, like boats and collectibles. Homeowners can take advantage of the Chubb Masterpiece Homeowners Coverage plan, which allows them to bundle basic coverage with enhanced policy options designed to extend coverage to earthquakes, flooding, and wildfire damages. California homeowners can also enroll in Chubb’s Wildfire Defense Service that helps homeowners protect their homes before, during, and after a fire.

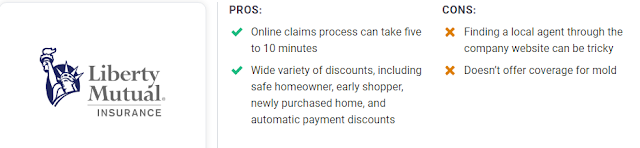

6. LIBERTY MUTUAL:

Liberty Mutual provides multiple insurance and investment products, including home, pet, and auto insurance. Homeowners can also purchase earthquake and a National Flood Insurance Program (NFIP) flood insurance policy through Liberty Mutual. Though its rates are notably lower than some of its competitors, Liberty Mutual has a robust collection of discounts that may help homeowners lower their premiums.

7. TRAVELERS:

Travelers homeowners insurance policies provide coverage for your main dwelling, other structures on your property, personal property, liability, and loss of use expenses. Optional coverages include extended coverage limits personal belongings and valuable items, losses due to identity theft, and dwelling and personal property replacement coverage. Travelers also offers earthquake and flood insurance, though its flood insurance is issued by its partner Neptune Flood, a private insurer.

In addition to its array of coverage, Travelers offers homeowners several discount opportunities to policyholders, including multi-policy bundling, claim-free histories for a certain period of time, and savings for installation of protective devices (e.g., smoke alarms and home security systems).

Average Home Insurance Cost in California

The average cost of homeowner insurance in California depends largely on the amount of coverage you want, typically ranging from $1,700 to $3,300 per year. However, if you live in an expensive area of California, your premiums will be higher than elsewhere. In addition to the amount of insurance, there are a number of other factors that can affect the cost of insurance in California. These include:

Age and style of construction: Newly constructed homes made of concrete or stone will have lower insurance premiums than homes made of wood. Wood construction is less durable and has a shorter lifespan than homes made of concrete or stone, making it more vulnerable to risk.

Your claim history: If you have filed a home insurance claim in the past three to five years, you will likely pay more for coverage.

Property loss history: If you recently purchased a home and the previous owner filed a claim in the past three to five years, this can also increase your insurance costs.

Location of the home: If your home is near a fault line or an area prone to wildfires or other hazards, you will likely pay more for coverage.

Conclude: Investing time into finding the best homeowner insurance in California has to offer will ultimately safeguard your investment and ensure that you are prepared for whatever challenges may come your way. Don’t settle; prioritize quality coverage that meets both your budget and needs!